Sidus system is one of most popular and efficient system trading among forex traders to reached success earning in forex. it can be used as determinant currently trend for long or short therm. this system also is combined results of BGX system and Vegas system which are quite popular system.

Applicatian this system is suggested to use currency pair EUR/USD and EUR/GBP (select one pair) and used this system when europe market open (14.00 WIB) or us market open(19.00 WIB).

some important indicators to support this system consist of:

-Time frame 1H use candlestic chart or bar chart type.

-EMA 18 and EMA 28 (both are red color) as tunnel

-WMA 5 (blue color) and WMA 8 (yellow color)

*about color can chose it as you like.

way to setup those indicators on marketiva, say you have logged in to streamster marketiva account:

setup timeframe 1 hour and candlestick chart or bar chart

-On main chart, right click it then will appear context menu say "time scale" select it and then chose "hourly" then grafic will representing price (open, close, high, low) every 1 hour, every chart update.

-Still on main chart, right click again on it then chose "style" and select "candlestick chart" or "bar chart"

setting EMA 18 and EMA 28 ( red color)

-On main chart, right click it, will appear context menu, select "indicators" then chose "moving average", fill the type being "Exponential" (EMA=Exponential moving average), change default period to "18" after that change the color click"line color" to red color.

-do the same as above for EMA 28.

now you have two lines with red color on chart, each as EMA 18 and EMA 28

setting WMA 5 (blue) and WMA 8 (yellow)

-On main chart , right click it then appear context menu , select "indicators" then selsct 'moving average", chose the type "weighted" (WMA=Weightedl Moving Average), change default period to 5 for WMA 5 and change period to 8 for WMA 8. and click line color to blue for WMA 5 and to yellow for WMA 8

now you have four lines on chart are EMA 18, EMA 28,WMA 5,WMA 8 ,save the chart and give a name any, such as: "sidus system", this is useful for future login on streamster marketiva you dont need to resetup it.

Application of this system trading:

EMA 18 and EMA 28:are as two tunnel lines which help you to determine when the trend has been starting and when the trend has been ending in long therm.

WMA 5 and WMA 8: are two lines will help you to determine when you have to entry to market and when you have to exit from the market. and these lines also can be used to predict the strength of the trend (short therm).

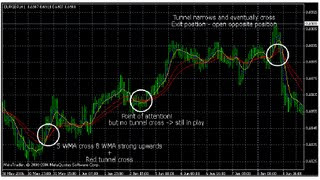

Entry signal:

Do entry position (buy or sell) only both lines of tunnel (EMA 18 and EMA 28) began to intersect or began to narrow.

Take Buy position if WMA-5 and WMA-8 crosses up the tunnel lines (EMA 18 and EMA 28) from under tunnel across to above it.

Take Sell position if WMA-5 and WMA-8 crosses the tunnel lines (EMA 18 and EMA 28) from above tunnel crosses to under it.

Exit position signal

if you have buy position, be carefull if WMA-5 crosses down through WMA-8 and exit position when WMA-5 and WMA-8 move down through tunnel line (EMA-18 and EMA-28)from top to bottom.

otherwise, if you have sell position, be carefull if WMA-5 crosses up through WMA-8 and exit position when WMA-5 and WMA-8 together crosses up through tunnel line(EMA-8 and EMA-28) from bottom to top.

And always exit your postion whatever that if tunnel line (EMA-8 and EMA-28) moved closer to each other even being cross shape , it shows change of trend will be hapened.

(read: trend reversal). in this case, you should reverse the posistion of the previous. remember, Make the trend as a friend.

example image :